Maximize Savings with Stacked Energy Efficiency Incentives in California

Home Green Homes Westside News

Archives

Maximize Savings with Stacked Energy Efficiency Incentives in California

SIGN UP FOR OUR NEWSLETTER

Maximize Your Savings: Stacking Energy Efficiency Incentives in California |

Discover how combining federal, state, and local programs can significantly reduce your home upgrade costs. |

Enhancing your home's energy efficiency might seem financially overwhelming at first glance.

However, by strategically combining various incentives—a practice known as stacking—you can substantially lower these expenses.

Understanding the Incentive Landscape

Federal Programs

The Inflation Reduction Act (IRA) provides substantial tax credits and rebates for energy-efficient home improvements.

For instance, homeowners can receive a 30% tax credit for installing renewable energy systems like solar panels, with no cap for most systems.

Additionally, the Energy Efficient Home Improvement Credit offers a 30% deduction on energy improvements such as heat pumps and insulation, capped at $1,200 annually for renovations and $2,000 for appliances.

State and Local Incentives

California has introduced several programs to promote energy efficiency.

The Home Electrification and Appliance Rebates (HEEHRA) program offers rebates up to $8,000 for low-to-moderate income households to install energy-efficient heat pump systems.

Additionally, the Home Owner Managing Energy Savings (HOMES) program, expected to launch soon, will provide rebates based on actual energy savings achieved through home upgrades.

Utility Rebates

Local utilities often provide rebates for energy-efficient appliances and systems.

For example, San Francisco's CleanPowerSF program offers bill credits up to $1,200 for residents upgrading to efficient heat pump water heaters.

These credits are distributed as $50 monthly bill credits over two years, helping offset the higher upfront costs of installation.

Manufacturer Promotions

Manufacturers frequently offer seasonal rebates or discounts on energy-efficient products.

These promotions can further reduce the cost of appliances like HVAC systems, windows, and smart thermostats.

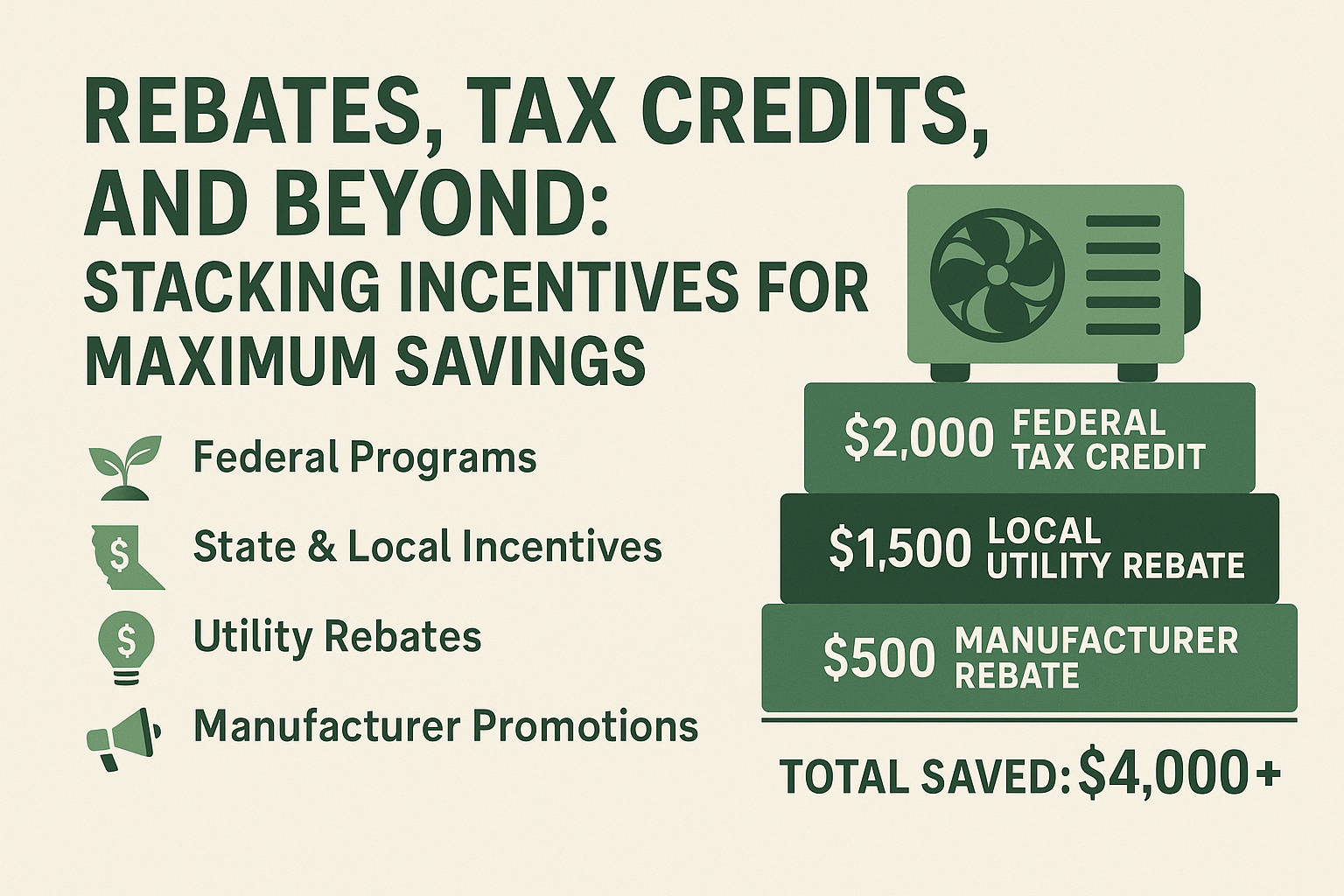

How Stacking Works

By layering these incentives, you can maximize your savings.

Consider replacing your traditional water heater with a heat pump water heater:

- $2,000 federal tax credit

- $1,200 local utility bill credits

- $500 manufacturer rebate

Total savings: $3,700—potentially covering a significant portion of the project cost.

It's crucial to review each program's guidelines, as some incentives may have specific eligibility requirements or may not be combinable.

Avoid Common Pitfalls

To ensure you fully benefit from available incentives:

- Confirm eligibility before purchasing equipment.

- Adhere to application deadlines.

- Maintain necessary documentation, such as proof of ENERGY STAR certification.

The Role of a Green Home Consultant

Navigating the array of incentives can be complex and time-consuming.

A green home consultant can assist by:

- Identifying all applicable programs.

- Planning upgrades for optimal return on investment.

- Managing timelines and paperwork to ensure no opportunities are missed.

Ready to Start Saving?

Upgrading your home for enhanced comfort, efficiency, and sustainability doesn't have to be financially burdensome.

With a well-structured plan, you can leverage multiple incentives to make improvements more affordable.

Consider taking a free Green Home Readiness Assessment to identify your most significant savings opportunities and receive a personalized roadmap to a healthier, more efficient home. |